Debit GST Paid Input 600. Debit Medical Expense 10000.

The goods or services are used or will be used for the purpose of your business.

. Basically all taxable persons will be required to account for GST based on accrual invoice basis of accounting ie. INLAND REVENUE BOARD OF MALAYSIA. 512 GST is also charged and levied on all.

When purchasing from GST-registered suppliers or importing goods into Singapore you may have incurred GST input tax. However certain categories of taxable persons may be allowed to use the payment cash basis of accounting. TARIKH KEMASKINI 06062021 03-8911 1000 Hasil Care Line 03-8751 1000 Hasil Recovery Call Centre LhdnTube LHDNMofficial LHDNM LHDNM wwwhasilgovmy.

The BL GST code will be used to record the. The Malaysia GST prohibits input tax claims on entertainment expenses to a person other than employees or existing customers probably to curb abuse. PART I EXPENSES PUBLIC RULING NO.

You can claim the input tax incurred when you satisfy all of the conditions for making such a claim. Lam Kok Shang and Gan Hwee Leng of KPMG preview the introduction of goods and services tax GST in Malaysia from April 1 2015 comparing it with the equivalent regime in Singapore and explaining what taxpayers must do to prepare for the incoming changes. You should only claim input tax in the accounting period corresponding to the date of the.

A imported goods except goods given relief or deposited into licensed warehouse designated areas or free commercial zones or under Approved Trader Scheme. The last category includes all purchases where no GST is claimable or no GST is charged. The goods or services are supplied to you or imported by you.

Conditions for Claiming Input Tax. GST incurred on entertainment expenses is only claimable if they are incurred to. All output tax and input tax are to be accounted and claimed based on the time when the invoice was issued or received.

You can claim input tax incurred on your purchases only if all the following conditions are met. Conditions for claiming input tax. GST incurred on entertainment expenses is only claimable if they are incurred to.

A medical expense of 10000 incurred with a GST of 600 Based on the Malaysia GST rate of 6. A medical expense of 10000 incurred with a GST of 600 Based on the Malaysia GST rate of 6. In Singapore and Malaysia BL GST code is an example of a non-claimable GST.

TaXavvy Issue 7-2017 2 Public rulings on income tax treatment of Goods and Services Tax The Inland Revenue Board IRB has recently issued Public Ruling 12017 Income Tax Treatment of Goods and Services Tax GST Part 1 Expenses PR 12017 and Public Ruling 22017 Income Tax Treatment of GST Part 2 Qualifying Expenditure for Purposes of Capital. Lam Kok Shang and Gan Hwee Leng of KPMG preview the introduction of goods and services tax GST in Malaysia from April 1 2015 comparing it with the equivalent regime in Singapore and explaining what taxpayers must do to prepare for the incoming changes. Conditions for claiming input tax.

There is no such restriction in Singapore. In Singapore and Malaysia BL GST code is an example of a non-claimable GST. The BL GST code will be used to record the medical expense and the double entry will be.

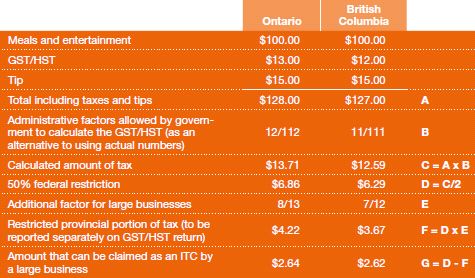

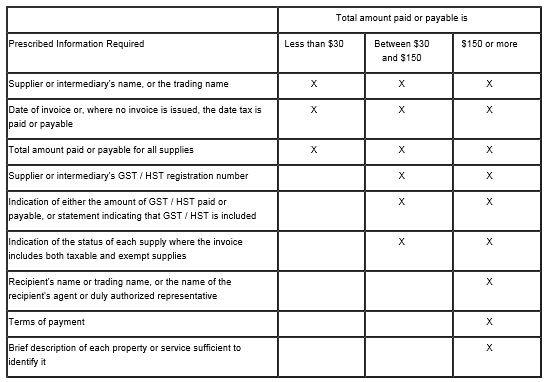

Gst Harmonized Sales Tax Hst Trips And Traps For Privately Owned Businesses Sales Taxes Vat Gst Canada

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

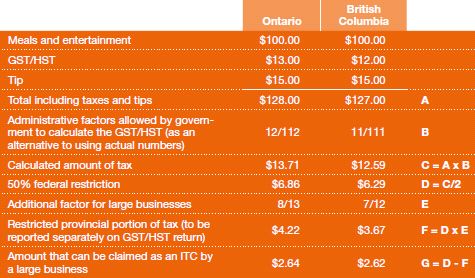

Documentation Requirements For Claiming Input Tax Credits The Letter Of The Law Sales Taxes Vat Gst Canada

Gst Harmonized Sales Tax Hst Trips And Traps For Privately Owned Businesses Sales Taxes Vat Gst Canada

Goods Services Tax In Singapore

What Is Gst And How Does It Work Infographic Xero Sg

Malaysia Sst Sales And Service Tax A Complete Guide

Finally Gst Goods And Services Tax Bill Has Been Passed In Rajya Sabha India We Would Be Hel Creative Advertising Goods And Service Tax Creative Branding

How To Get Gst Refund Indiafilings